Macrs Depreciation Table For Non Residential Property . special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. your use of either the general depreciation system (gds) or the alternative depreciation system (ads) to depreciate property. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous. With this handy calculator, you can calculate the depreciation schedule for depreciable. — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s.

from www.chegg.com

— the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. your use of either the general depreciation system (gds) or the alternative depreciation system (ads) to depreciate property. With this handy calculator, you can calculate the depreciation schedule for depreciable. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous.

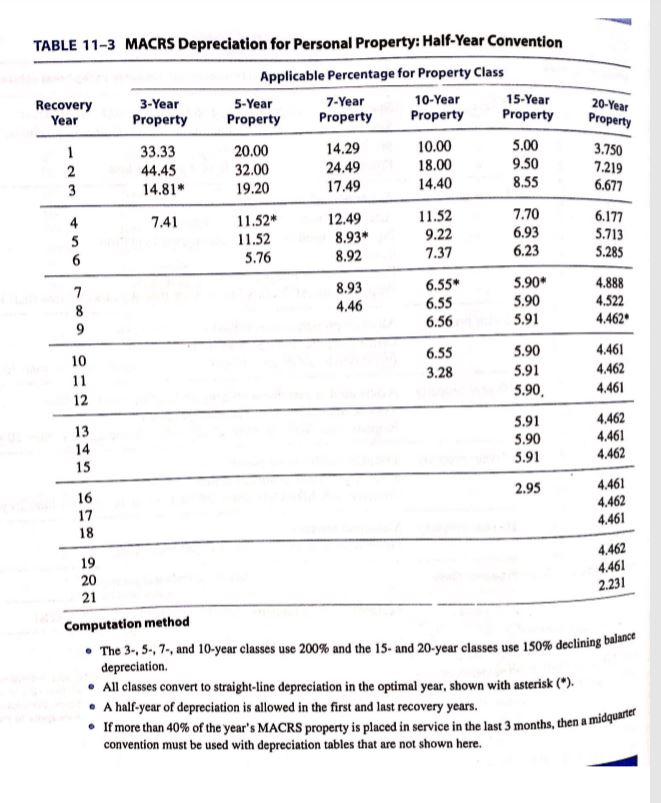

TABLE 113 MACRS Depreciation for Personal Property

Macrs Depreciation Table For Non Residential Property — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous. your use of either the general depreciation system (gds) or the alternative depreciation system (ads) to depreciate property. With this handy calculator, you can calculate the depreciation schedule for depreciable.

From www.chegg.com

A. Using MACRS, what is Javier’s depreciation Macrs Depreciation Table For Non Residential Property the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous. With this handy calculator, you can calculate the depreciation schedule for depreciable. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. . Macrs Depreciation Table For Non Residential Property.

From www.chegg.com

Solved Table 1 MACRS HalfYear Convention Depreciation Rate Macrs Depreciation Table For Non Residential Property your use of either the general depreciation system (gds) or the alternative depreciation system (ads) to depreciate property. — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december. Macrs Depreciation Table For Non Residential Property.

From www.chegg.com

TABLE 113 MACRS Depreciation for Personal Property Macrs Depreciation Table For Non Residential Property — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. your use of either the general depreciation system (gds) or the alternative depreciation system (ads) to depreciate property. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense. Macrs Depreciation Table For Non Residential Property.

From www.irs.gov

Publication 946 (2017), How To Depreciate Property Internal Revenue Macrs Depreciation Table For Non Residential Property — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed. Macrs Depreciation Table For Non Residential Property.

From youngandtheinvested.com

MACRS Depreciation, Table & Calculator The Complete Guide Macrs Depreciation Table For Non Residential Property — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. With this handy calculator, you can calculate the depreciation schedule for depreciable. your use of. Macrs Depreciation Table For Non Residential Property.

From youngandtheinvested.com

MACRS Depreciation, Tables, & Method (All You Need to Know!) Macrs Depreciation Table For Non Residential Property your use of either the general depreciation system (gds) or the alternative depreciation system (ads) to depreciate property. With this handy calculator, you can calculate the depreciation schedule for depreciable. — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. special depreciation allowance is 60% for certain qualified. Macrs Depreciation Table For Non Residential Property.

From www.asset.accountant

What is MACRS Depreciation? Macrs Depreciation Table For Non Residential Property your use of either the general depreciation system (gds) or the alternative depreciation system (ads) to depreciate property. With this handy calculator, you can calculate the depreciation schedule for depreciable. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous. — the modified accelerated cost. Macrs Depreciation Table For Non Residential Property.

From fitsmallbusiness.com

MACRS Depreciation Tables & How to Calculate Macrs Depreciation Table For Non Residential Property With this handy calculator, you can calculate the depreciation schedule for depreciable. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. your use of. Macrs Depreciation Table For Non Residential Property.

From www.chegg.com

Solved Table 1 MACRS HalfYear Convention Depreciation Rate Macrs Depreciation Table For Non Residential Property your use of either the general depreciation system (gds) or the alternative depreciation system (ads) to depreciate property. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in. Macrs Depreciation Table For Non Residential Property.

From youngandtheinvested.com

MACRS Depreciation Table Guidance, Calculator + More Macrs Depreciation Table For Non Residential Property — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous. With this handy calculator, you can calculate the depreciation schedule for depreciable. your use of either. Macrs Depreciation Table For Non Residential Property.

From www.chamberofcommerce.org

Guide to the MACRS Depreciation Method Chamber Of Commerce Macrs Depreciation Table For Non Residential Property special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. your use of either the general depreciation system (gds) or the alternative depreciation system (ads) to depreciate property. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any,. Macrs Depreciation Table For Non Residential Property.

From www.chegg.com

TABLE 113 MACRS Depreciation for Personal Property Macrs Depreciation Table For Non Residential Property special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous. With this handy calculator, you can calculate the depreciation schedule for depreciable. . Macrs Depreciation Table For Non Residential Property.

From www.exceldemy.com

How to Use MACRS Depreciation Formula in Excel (8 Methods) Macrs Depreciation Table For Non Residential Property With this handy calculator, you can calculate the depreciation schedule for depreciable. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. . Macrs Depreciation Table For Non Residential Property.

From www.exceldemy.com

How to Use MACRS Depreciation Formula in Excel (8 Methods) Macrs Depreciation Table For Non Residential Property the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. your use of either the general depreciation system (gds) or the alternative. Macrs Depreciation Table For Non Residential Property.

From alquilercastilloshinchables.info

8 Pics Macrs Depreciation Table 2017 39 Year And View Alqu Blog Macrs Depreciation Table For Non Residential Property special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. the carryover of disallowed deduction from 2022 is the amount of section 179 property, if any, you elected to expense in previous. With this handy calculator, you can calculate the depreciation schedule for depreciable. . Macrs Depreciation Table For Non Residential Property.

From cabinet.matttroy.net

Macrs Depreciation Table 2016 Matttroy Macrs Depreciation Table For Non Residential Property special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. With this handy calculator, you can calculate the depreciation schedule for depreciable. — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. the carryover of. Macrs Depreciation Table For Non Residential Property.

From www.chegg.com

Solved Table 1 MACRS HalfYear Convention Depreciation Rate Macrs Depreciation Table For Non Residential Property — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. With this handy calculator, you can calculate the depreciation schedule for depreciable. your use of either the general depreciation system (gds) or the alternative depreciation system (ads) to depreciate property. special depreciation allowance is 60% for certain qualified. Macrs Depreciation Table For Non Residential Property.

From iteachaccounting.com

Depreciation Tables Macrs Depreciation Table For Non Residential Property — the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. With this handy calculator, you can calculate the depreciation schedule for depreciable. special depreciation allowance is 60% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2023, and. the carryover of. Macrs Depreciation Table For Non Residential Property.